Navigating Tariffs and Duties in Global Trade Markets

Understanding Tariffs: What Are They and Why Do They Matter?

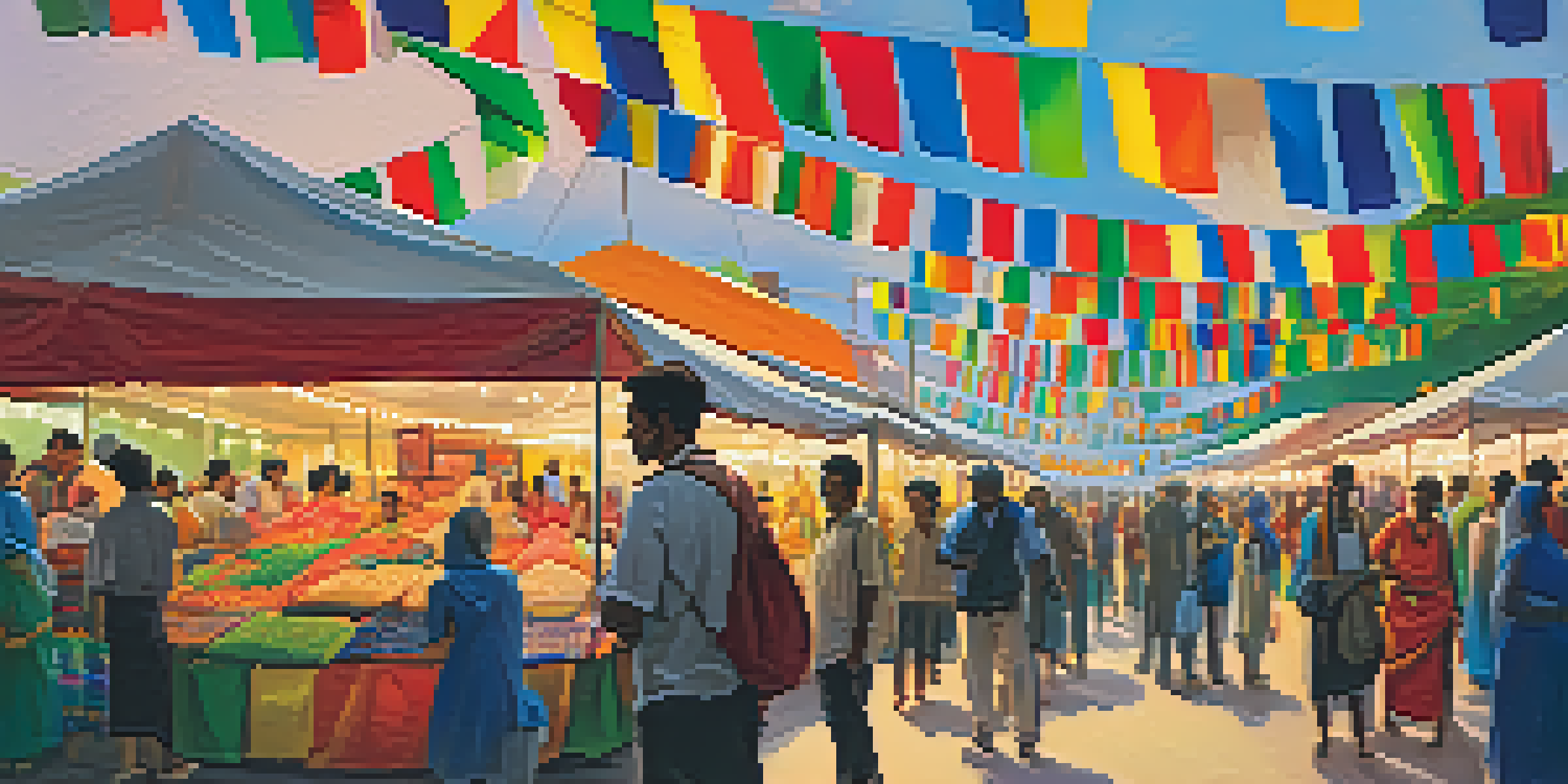

Tariffs are taxes imposed on imported goods, designed to protect domestic industries by making foreign products more expensive. Imagine you're at a fair, where local vendors sell their goods. If a neighboring vendor suddenly offers the same product at a lower price, a tariff acts like a ticket fee that raises their price, encouraging you to buy local.

Trade is a game of negotiation, and tariffs are the rules that govern that game.

These taxes can significantly influence pricing strategies for businesses engaged in global trade. For instance, if a company imports electronics and faces a high tariff, it might pass that cost onto consumers, making their products less competitive. This creates a ripple effect throughout the market, impacting both consumers and producers.

Understanding tariffs is crucial for any business looking to expand internationally. By staying informed about these costs, companies can make better pricing decisions and potentially explore alternative markets where tariffs are lower.

Duties Explained: Distinguishing Between Tariffs and Duties

While tariffs specifically refer to the taxes on imports, duties are broader and can include various fees associated with importing goods. Think of duties as the umbrella term, under which tariffs and other charges like excise taxes fall. This distinction is vital for businesses to navigate the complex waters of international trade.

Duties can vary based on the nature of the goods, their value, or even their origin. For example, luxury items might carry higher duties compared to essential goods. Understanding these nuances allows companies to plan their budgets and manage their supply chains more effectively.

Understanding Tariffs and Duties

Tariffs are taxes on imports that protect domestic industries, while duties encompass various fees related to importing goods.

By familiarizing themselves with both tariffs and duties, businesses can identify potential cost-saving measures. This knowledge can also help in negotiations with suppliers and logistics partners, ensuring that all parties are on the same page regarding import costs.

Calculating Tariffs and Duties: How to Get It Right

Calculating tariffs and duties can feel like solving a complex puzzle, but it doesn't have to be overwhelming. Businesses typically need to know the product's classification code, which determines the applicable rates. This code, known as the Harmonized System (HS) code, acts like a universal language for trade.

In the world of trade, knowledge is power. Understanding tariffs and duties can make or break your business.

Once you have the HS code, you can research the specific tariff rates for your product. Many countries provide online databases that detail these rates, making it easier to estimate potential costs. For example, if you're importing textiles, knowing the exact rate can help you budget accordingly and avoid surprises.

Additionally, using customs brokers can simplify this process. These professionals specialize in navigating the intricacies of tariffs and duties, providing guidance tailored to your specific imports, which can save time and reduce errors.

Trade Agreements: Their Role in Tariffs and Duties

Trade agreements between countries can significantly lower or eliminate tariffs, creating a more favorable environment for businesses. For instance, the North American Free Trade Agreement (NAFTA), now replaced by the United States-Mexico-Canada Agreement (USMCA), aimed to reduce trade barriers among its member nations.

These agreements often promote economic cooperation and can lead to increased market access for businesses. By leveraging trade agreements, companies can lower their operational costs and increase competitiveness in the global market. Understanding the terms of these agreements is essential for any business looking to take advantage of lower tariffs.

Importance of Compliance

Businesses must navigate complex regulations to ensure compliance with tariff and duty laws, avoiding costly errors.

However, it's important to note that not all products benefit from these agreements. Some items may still face high tariffs, so thorough research is necessary to identify which goods can take advantage of reduced rates.

Common Challenges in Tariff and Duty Compliance

Compliance with tariff and duty regulations can be a daunting task for businesses, especially when dealing with multiple countries. Each country has its own rules, documentation requirements, and enforcement practices, which can lead to confusion and potential penalties for non-compliance.

One common challenge is the misclassification of goods, which can result in underpayment or overpayment of duties. For example, importing machinery as a different type of equipment could lead to unexpected costs. Therefore, ensuring accurate classification is vital for avoiding costly mistakes.

To overcome these challenges, businesses can implement robust compliance programs that include training for staff and regular audits of import processes. This proactive approach can help mitigate risks and ensure that organizations stay on the right side of regulations.

Navigating Tariff Changes: Staying Updated

Tariff rates and regulations are not static; they can change frequently based on political and economic factors. Staying updated on these changes is essential for businesses engaged in global trade. Subscribing to industry newsletters or following trade organizations can provide timely information on tariff adjustments.

Moreover, participating in trade shows and networking events can also offer insights into market trends and regulatory updates. Engaging with peers in the industry can help businesses anticipate changes and adapt their strategies accordingly.

Staying Informed on Changes

Regularly updating knowledge on tariff rates and regulations is crucial for businesses to remain competitive in global trade.

By being proactive and informed, companies can better position themselves to respond to tariff changes, ensuring that their operations remain efficient and cost-effective.

The Future of Tariffs and Duties in Global Trade

As globalization continues to evolve, the landscape of tariffs and duties will likely undergo significant changes. Emerging markets and shifting trade alliances could lead to new tariff structures and compliance requirements. Businesses must stay agile and ready to adapt to these evolving conditions.

Additionally, trends like digital trade and e-commerce are reshaping how tariffs are applied. For instance, the rise of online marketplaces has prompted discussions about how to tax goods sold across borders. Companies should be prepared to navigate these complexities as they emerge.

Ultimately, understanding the future of tariffs and duties will require businesses to remain engaged with trade policies and adapt their strategies accordingly. By staying informed and flexible, companies can thrive in the ever-changing global market.